Hello and welcome to this tutorial video on how to submit and check the status of your travel voucher. The easiest and most secure way to submit your travel voucher is with Travel Voucher Direct. Travel Voucher Direct can be accessed from the Defense Finance and Accounting Services website, DFAS. To access Travel Voucher Direct, select either the "Military Members" or "Civilian Employees" options from the home screen. Travel Voucher Direct can be found under "Travel Pay." Click the link to access Travel Voucher Direct to submit your voucher. To submit your voucher, click on "Submit" in the subcategories menu. Select your type of travel in order to submit your voucher. You must first fill out the form, beginning with your name. Then, enter and confirm your email address. In the passcode field, enter a passcode. Pass codes can be 4 to 40 characters long and can have letters, numbers, and/or special characters. However, they cannot contain your email address or name. Pass codes are for submission purposes only and will not be needed in the future. Next, upload your voucher orders, along with all amendments, receipts, and other paperwork, in the attachments section. Click the "Browse" button to find your file, locate your file, and click "Open." You can upload one file at a time, up to 10 files total, with a size limit of 35 total megabytes. Once you have uploaded all the required files for your claim, click "Upload Attachments," then click "Submit." Your voucher has been submitted, and you will receive a confirmation email shortly. Once submitted, please allow two business days before checking the status of your voucher. The easiest way to check the status of your voucher is through the online status tool on our website. To access the online status tool, select either...

Award-winning PDF software

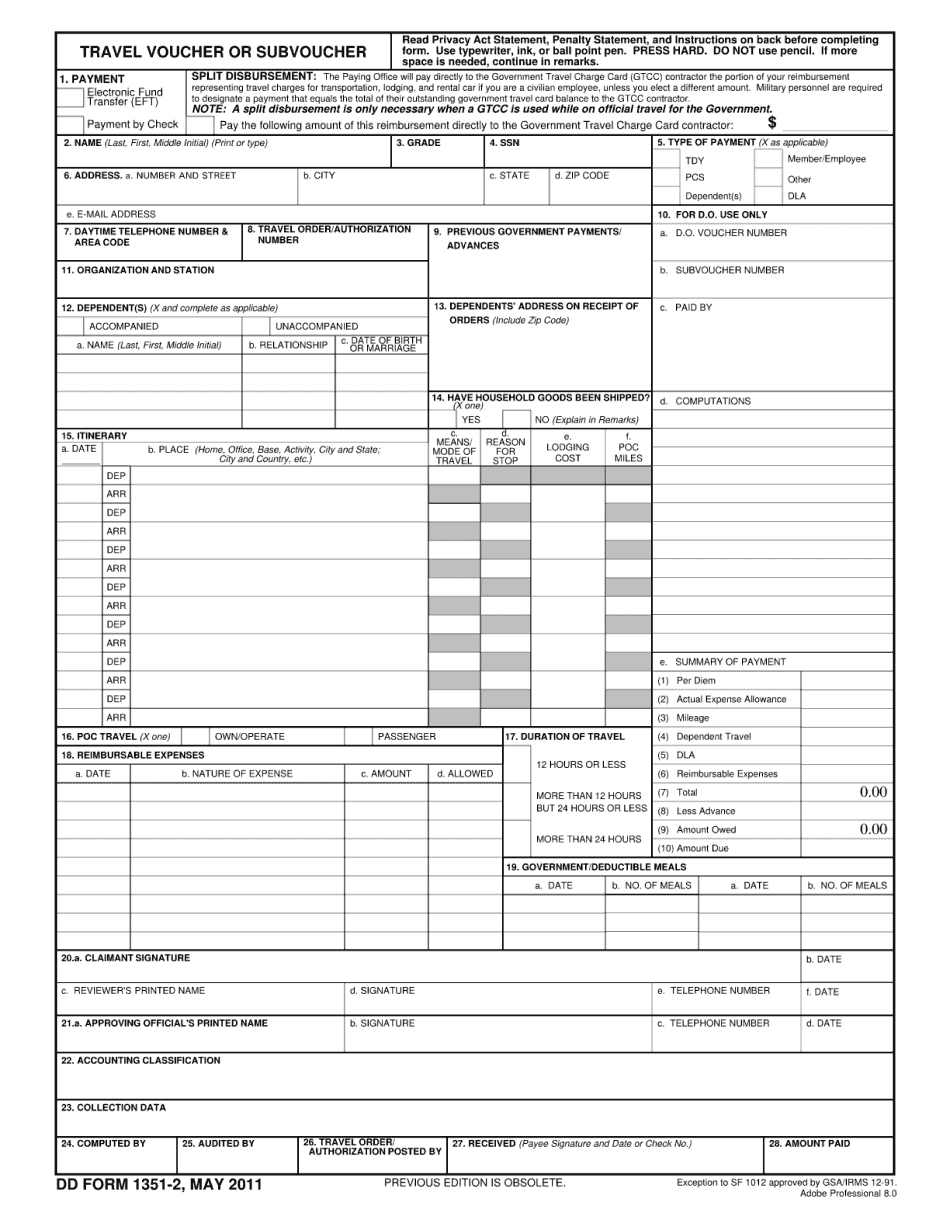

Dd 1351 2 reimbursable expenses Form: What You Should Know

DD Form 1351-2, May 2025 PREVIOUS EDITION IS OBSOLETE. Representing transportation charges for transportation, lodging, and rental car if you are a civilian employee, DD Form 1351-2, May 2025 PREVIOUS EDITION IS OBSOLETE. Representing transportation charges for transportation, lodging, and rental car if you are a civilian employee, DD Form 1351-2, May 2025 PREVIOUS EDITION IS OBSOLETE. Representing transportation charges for transportation, lodging, and rental car if you are a civilian employee, DD Form 1351-2, May 2025 PREVIOUS EDITION IS OBSOLETE. Representing transportation charges for transportation, lodging, and rental car if you are a civilian employee, DD Form 1351-2, May 2025 PREVIOUS EDITION IS OBSOLETE. Representing transportation charges for transportation, lodging, and rental car if you are a civilian employee, DD Form 1351-2, May 2025 PREVIOUS EDITION IS OBSOLETE. Representing transportation charges for transportation, lodging, and rental car if you are a civilian employee, DD Form 1351-2, May 2025 PREVIOUS EDITION IS OBSOLETE. Representing transportation charges for transportation, lodging, and rental car if you are a civilian employee, DD Form 1351-2, May 2025 PREVIOUS EDITION IS OBSOLETE. Representing transportation charges for transportation, lodging, and rental car if you are a civilian employee, DD Form 1351-2, May 2025 PREVIOUS EDITION IS OBSOLETE. Representing transportation charges for transportation, lodging, and rental car if you are a civilian employee, DD Form 1351-2, May 2025 PREVIOUS EDITION IS OBSOLETE. Representing transportation charges for transportation, lodging, and rental car if you are a civilian employee, DD Form 1351-2, May 2025 PREVIOUS EDITION IS OBSOLETE. Representative of transportation charges for a rental car DD Form 1351-2, May 2025 PREVIOUS EDITION IS OBSOLETE. Representative of transportation charges for a rental car DD Form 1351-2, May 2025 PREVIOUS EDITION IS OBSOLETE.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Dd 1351-2, steer clear of blunders along with furnish it in a timely manner:

How to complete any Dd 1351-2 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Dd 1351-2 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Dd 1351-2 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Dd Form 1351 2 reimbursable expenses