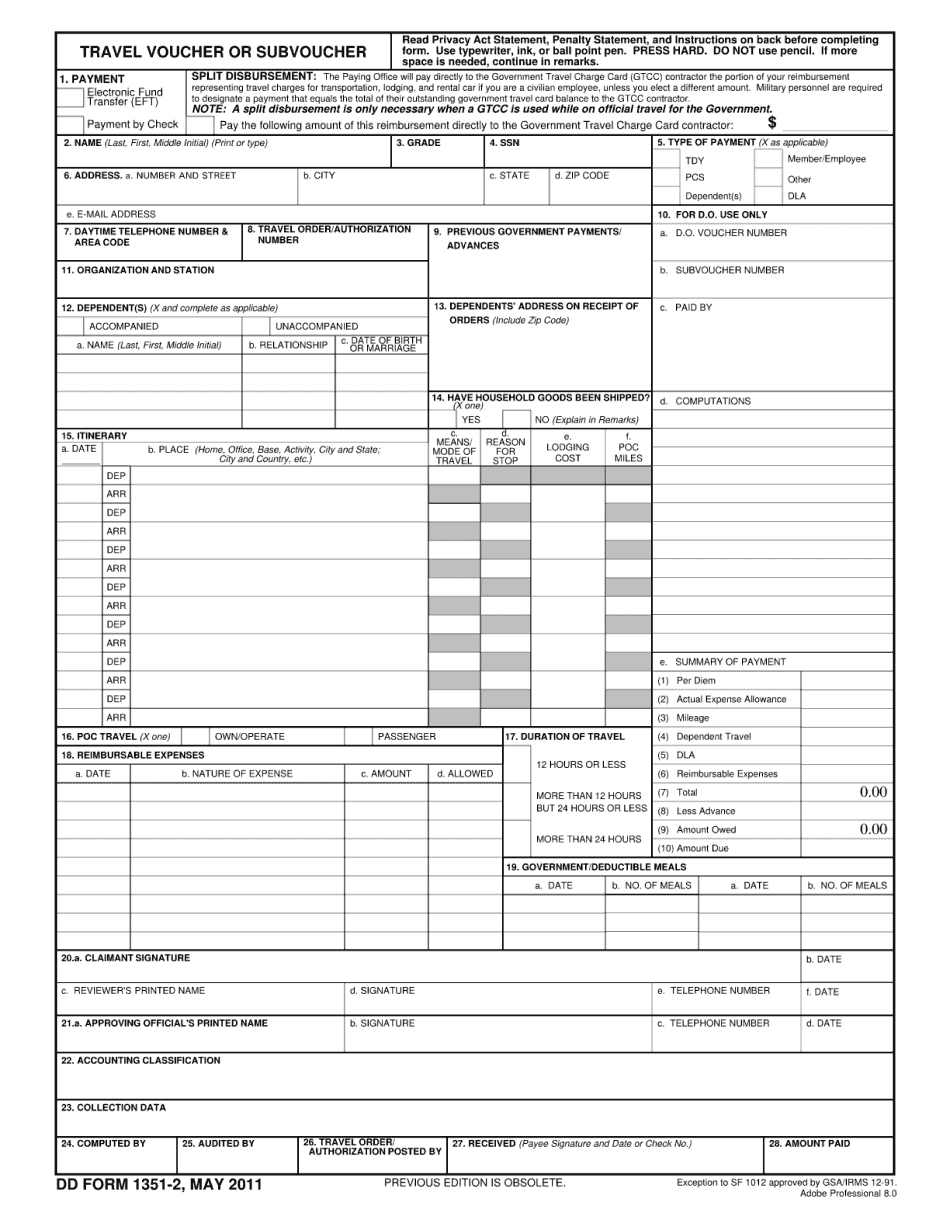

Now we're at the travel voucher and sub outer 1351 tattoo. The first thing you see on your form, there will be pavement. Please check and I'm trying to fund transfer, and most of you should have a bacon account set up with Vincent, so your money will be transferred into your account. Block number two, you type your name. Block number three, your grain. In this case, aux. Well, you don't forget to social security number. Then block by type of payment should be TDY and members employee. In block six, putting your address. If you're writing and not using a type of computer, please write legibly the city state and zip code. Also, add your email address, also your daytime telephone, and your TDY order number, which will be 11 9 3 39 s 46000. In block 11, you put an organization station. In this case, it will be d13 auxiliary. He was killed through 12 and 13 and go to block 15. You put in the year 2009. Scroll down and go type in the date of your travel. Tab over. For the most part, we have people that travel outside the state, so let's do one going to San Francisco. The first thing you want to put in home, the mode of transportation from your home to the airport would be P a now PA represent mode of trouble, which is your personal vehicle tableau to reason to stop it, don't tap over. Okay, now you put in the date again tab at sea-tac airport, or sea-tac International Airport. Now you add the reason for stop right in there and up in that 80. The reason you're waiting transportation, and as you wait for your transportation, you get onto your plane, which would be TP transportation...

Award-winning PDF software

Dd 1351-2 example Form: What You Should Know

All items of reimbursable expenses for travel are paid for using this travel voucher (DD Form 1351-2) issued by the United States Department of Defense (USAID). The Travel voucher is made from the Travel account(s), (if a Military Travel account has a balance, this is referred to as “Payable Travel Credit”). These authorized travel credits can be used for travel or for other purposes. Travel funds are not required to be applied to a specific travel voucher number or to the total of an individual's travel credit balance. The amount of Travel Funds that can be applied to a travel voucher varies, depending on the account or travel account number. A travel voucher must consist of a travel voucher with all required travel vouchers and a travel voucher, receipt card or invoice for services rendered. The travel voucher must, when issued, be in the possession of the military personnel to whom they refer, and must be presented upon their request. When the travel voucher is presented, the military person must complete and return the required portions of the DD Form 1351-2 to the GCC contractor for payment to the travel voucher issuer. Travel voucher holders are responsible for ensuring that the vouchers they are issued contain sufficient funds to cover all such costs as listed on the voucher and any additional amount due other than any amount required to be deducted as a charge from the Travel Credit. For the purposes of this travel voucher guide there are two types of travel vouchers, Travel Vouchers: 1) Travel Vouchers issued by U.S. Department of Defense contractors and 2) Travel Vouchers issued by the GCC contractor to the holder. The following list contains a summary of all voucher types for military individuals and their travel account numbers as issued by their respective U.S. Department of Defense contracting agencies. However, any travel vouchers not listed below are to be submitted for processing for the same reasons as the others mentioned above. Military vouchers not included in the menu are in the menu on the left. Travel vouchers 1)issued by U.S. Government contractors, Army, Navy, Air Force, Marine Corps, and Coast Guard 2)issued by the GCC contractor 3)issued by Air Force 4)issued by Army 5)issued by Naval Force 6)issued by Navy 7)issued by Coast Guard Military personnel should review the requirements outlined below for traveling in the United States using United States Government contractors.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Dd 1351-2, steer clear of blunders along with furnish it in a timely manner:

How to complete any Dd 1351-2 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Dd 1351-2 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Dd 1351-2 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Dd Form 1351-2 example