Award-winning PDF software

Dd 1551-2 Form: What You Should Know

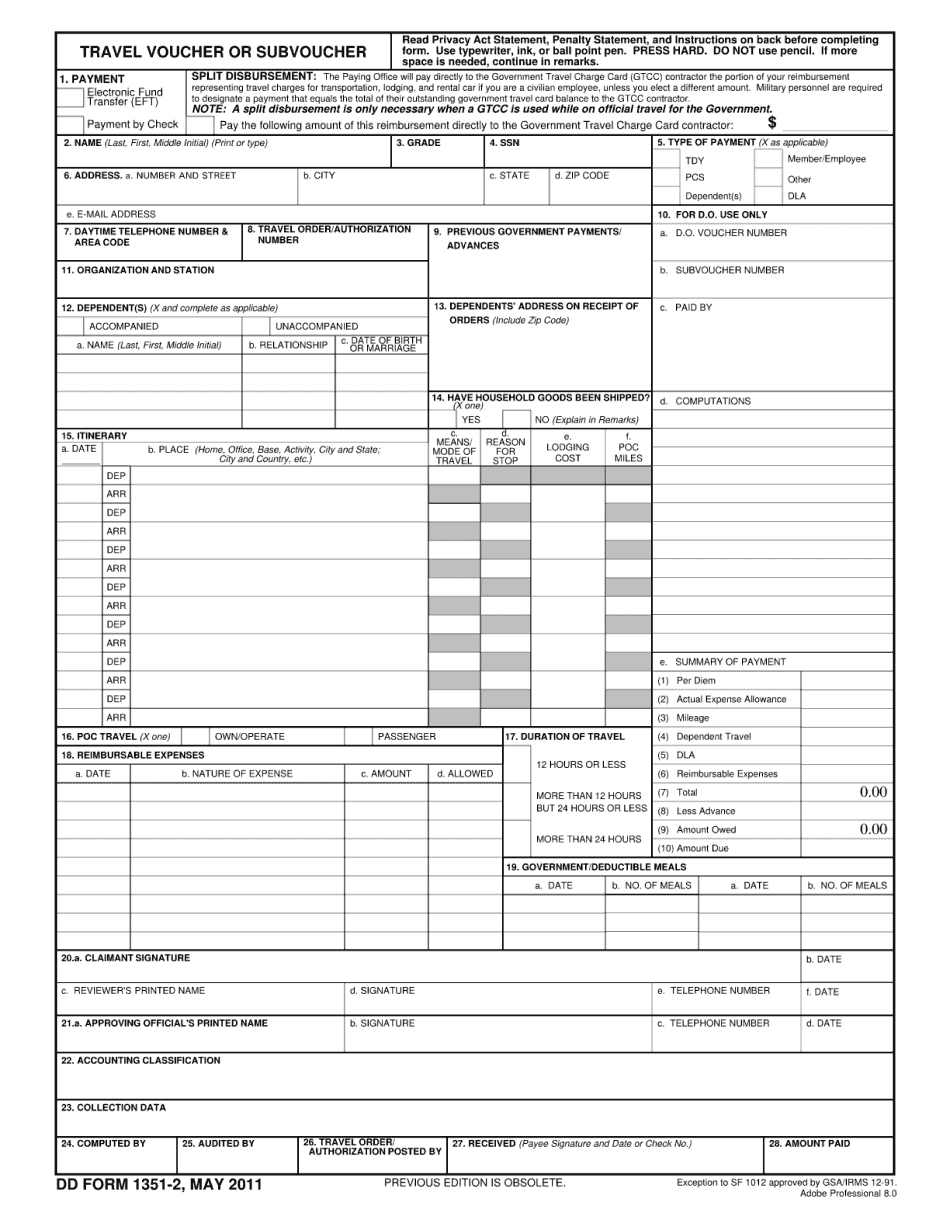

Get the dd form 1551-2 and print it out using the page layout that best works best for you and that's easier for you to read than a traditional paper printout. Your records and notes stay securely in your hands. You can always print out a new dd form 1551-2 with new travel details or add travel details from the travel voucher later. Get the dd form 1551-2 and email to yourself or make a copy and keep a backup copy for safe keeping. Save the dd form 1551-2 and other forms for future review in case you need to go back and edit and change information. PURPOSE: When you purchase your travel voucher, there are fees that you have to pay. The funds you pay for that voucher will pay the difference between what the Government reimburses you for your travel travel voucher and what the Department of Defense reimburses you for the same travel, plus any other costs that accrue out of your reimbursement. REFUNDS AND ACCOUNTS: To obtain a refund, submit your DD Form 1551-2 Travel Voucher(s) within 180 days of the estimated date of return of your trip. To obtain any reimbursement. Submit a copy of your receipt or documentation showing the purchase of the same type of travel voucher or a travel voucher to the Travel Voucher Office. Once you file, we will notify you electronically of your refund. YOU SHOULD NOT CONTACT THE PAYING OFFICE WITH QUESTIONS REGARDING YOUR REFUNDS OR ACCOUNTS. It is your responsibility with the assistance of your legal counsel and financial experts to obtain any payments you qualify for. The payment options and eligibility requirements are posted here and on my online Travel Services Web page. To view my complete refund information, click here. Do not let the Payment Options on these sites interfere with the process of receiving actual compensation that is due you or the Department of Defense. If your reimbursement is not available to you, please contact me at the Travel Voucher Office for a reimbursement request, or use the Customer Contact Form here. DEPARTMENT OF CHAPLAIN ARY SERVICES Office of Military and Veterans' Affairs 1115 Constitution Ave., NW Washington, DC 20229 Receipts must be postmarked before the end of the month the voucher was issued. A reimbursement of reimbursement for the same trip must be submitted within 180 days of the date of the voucher.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Dd 1351-2, steer clear of blunders along with furnish it in a timely manner:

How to complete any Dd 1351-2 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Dd 1351-2 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Dd 1351-2 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.