Award-winning PDF software

Dd 2560 advance pay certification/authorization Form: What You Should Know

Ask at the pay center whether there is a form that you may use. Form 2560 It was originally developed to simplify the process of using Payroll Deductions at the time it was issued. It is one of the most frequently used forms. The form includes a number of options for making payments; however, it is not always in the company's best interest to utilize all the options. For those who wish to utilize an advance pay authorization form, the best option is to complete and sign the DD Form 1033 and submit it to the pay center. The pay center is normally the last place to verify advance pay documentation. The DoD Advance Pay Certification/Authorization (DD Form 1033) — Envelope (PDF) A blank and secured envelope (i.e. with no identifying information) is required to use Form 1033. It is the preferred envelope type to be used in lieu of a paper form. This advanced pay authorization form is used by personnel in the Navy, Marine Corps, Air Force, and Coast Guard to ensure they have a clear record of earnings earned from military service. If this form is not used, it can negatively impact an individual's financial eligibility to receive federal, state/local, and private sector pensions and other benefit payments. Please note that the military pays for advance pay on a month-after-month basis, so this form remains effective until the next payroll period. Envelope size — 11-3/4” x 13-3/4” Order from DoD This advanced pay Authorization form has been developed and is available for download. If you wish to order copies of the form in different formats, please contact the Pay Center at the address provided in this page. Advance pay Authorization form DD Form 1033 (PDF | MS Word | Word Perfect) Download Advance Pay Authorization form from this link. The form begins with an acknowledgement letter to the recipient acknowledging receipt of the enclosed document. A signature box is then provided where the recipient may sign and date the document. The signed copy is sealed with a thumbprint of the person signing.

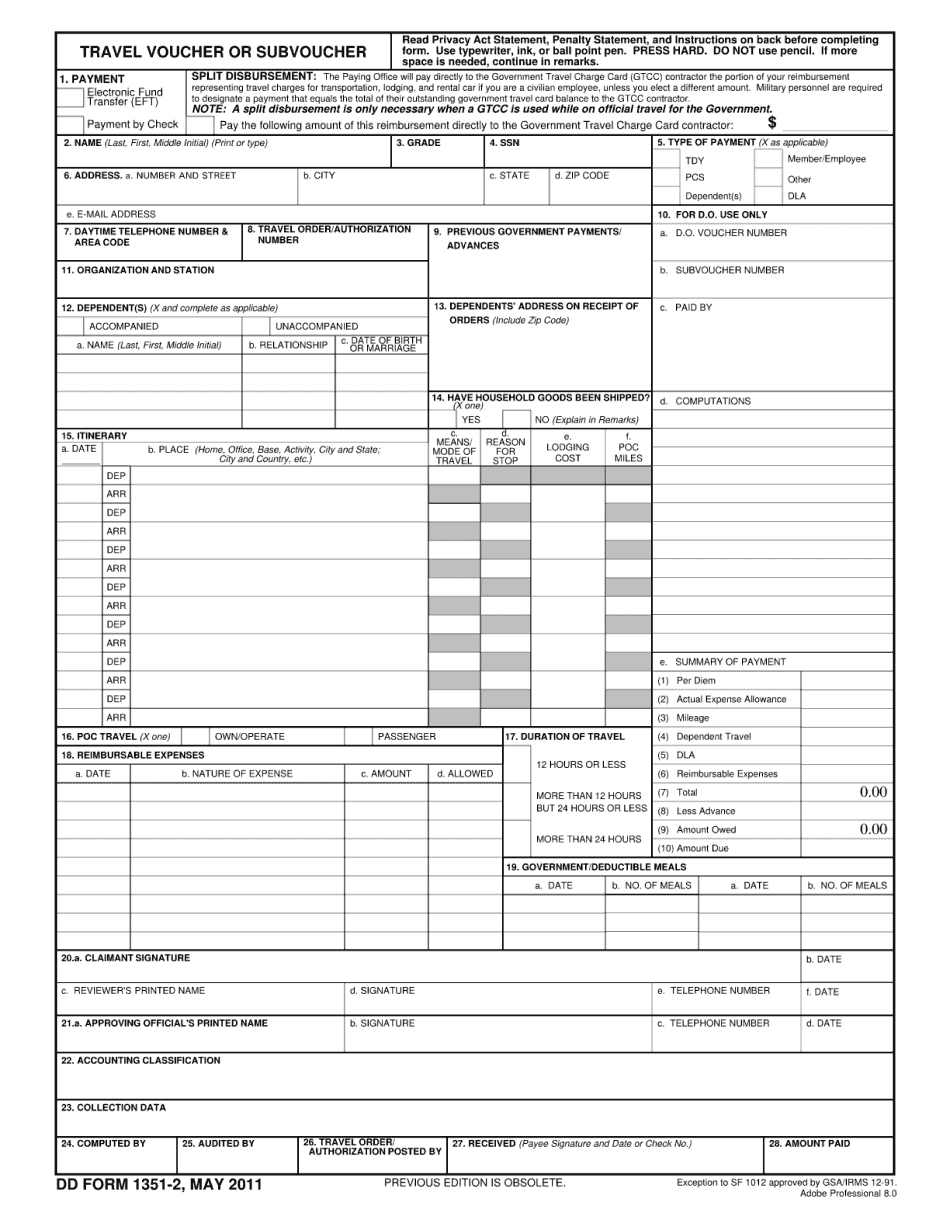

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Dd 1351-2, steer clear of blunders along with furnish it in a timely manner:

How to complete any Dd 1351-2 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Dd 1351-2 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Dd 1351-2 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.