Award-winning PDF software

Http www dfas mil militarymembers travelpay s HTML Form: What You Should Know

For a quick review, log into Defense Finance and Accounting Service > MilitaryMembers Apr 6, 2025 — Our website has been updated (Apr 6, 2018). For updates on all the services offered by DIAS visit the Services and Resources page MilitaryMembers: The Department of Defense will pay the following travel and travel related expenses for military members who are deployed to one of the following parts of the world: Afghanistan, Iraq, or Syria. The Department of Defense will pay travel and incidental expenses for travel to Afghanistan or Iraq as well. Travel and travel related expenses are not covered under the Post-9/11 GI Bill. All other dependent eligibility needs to be resolved at the local Pay Center, and this may include travel, medical and educational travel expenses. DIAS, however, covers these out-of-pocket expenses. The following information will answer common questions that you may have about DOD travel and related resources: — Who pays for military travel expenses? — Where does the money for travel expenses come from? — Is it a hardship for those who are deployed to these areas? — What are the options for a military travel expense? DoD Travel Related Costs Military members of the Army, the Marine Corps, and Coast Guard, as well as members of the other Armed Services who are in active service and are on active duty, are not eligible for the Post-9/11 GI Bill. As a result, these Military Personnel (MOP) must pay for their own travel and travel related expenses. DOD is responsible for paying the costs of travel, accommodation, meals and other related meals in their home of record. To receive transportation, meals, and other travel related costs from DOD, Military Personnel must apply within 90 days of arriving at their home of record. Travel expenses paid for by the Federal Reserve System (FRS) are not tax-deductible. All military travel is incurred under the responsibility of the Military Department, which is the Military Services. In the case of military duty, expenses paid by the parent agency for personal activities are not counted as travel between duty locations. This means that Travel, Accommodations, Meals & Other Related Meals (TAM) and all other personal expenses associated with travel must be paid under the parent agency (Federal Reserve System, military Police/Security, or their respective family member if traveling with the spouse) of the Military Personnel, even when the Military Personnel are on duty.

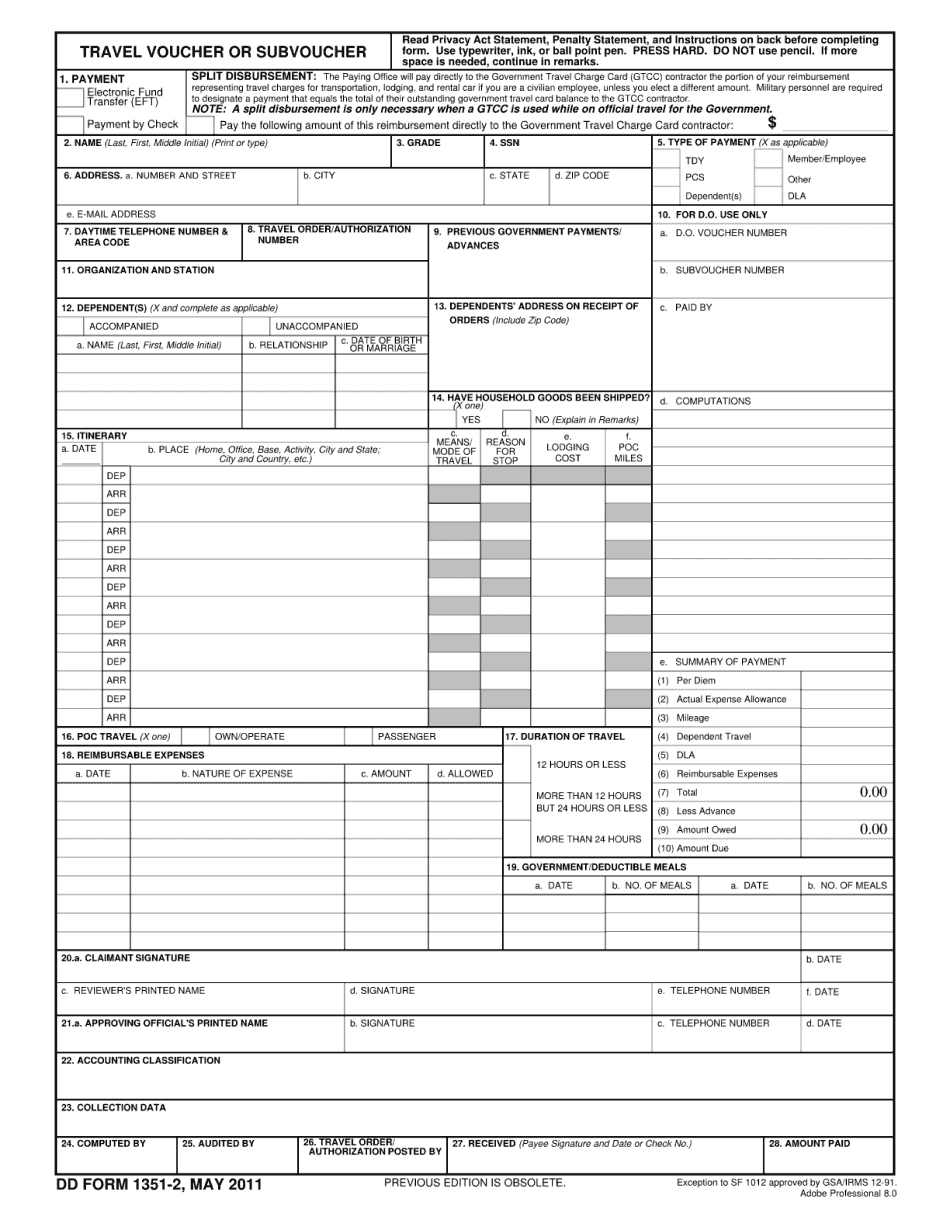

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Dd 1351-2, steer clear of blunders along with furnish it in a timely manner:

How to complete any Dd 1351-2 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Dd 1351-2 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Dd 1351-2 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.